In the face of a global economic downturn, the luxury market not only remains steadfast but experiences unprecedented expansion. While the world grapples with the repercussions of the pandemic and conflicts, luxury brands flourish, setting records and exceeding market projections.

This article delves into the factors driving the surge in the luxury sector, spotlighting four crucial segments: personal luxury goods, luxury cars, private jets, and luxury real estate.

Personal Luxury Goods: A Sanctuary Of Extravagance

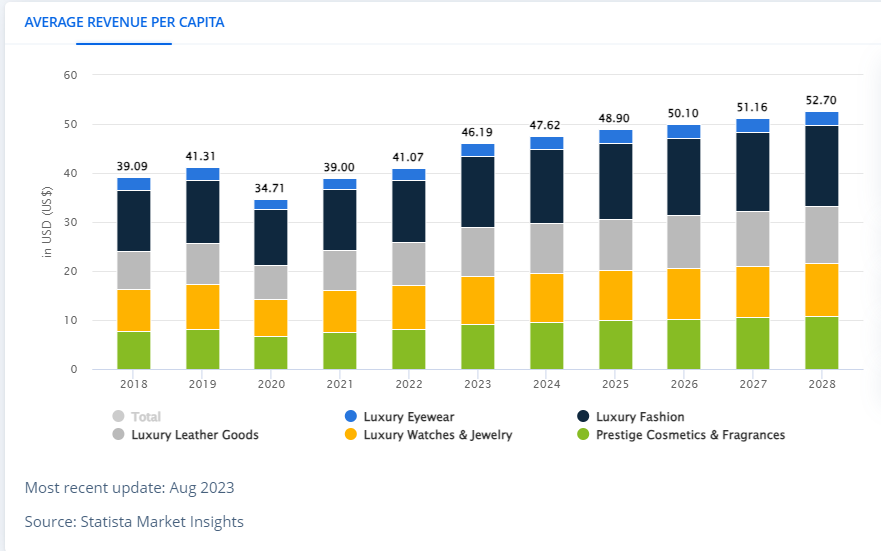

The market for personal luxury goods, encompassing high-end fashion, premium cosmetics, designer handbags, and exquisite jewelry, has exhibited consistent growth over decades. Despite economic downturns such as the 2008 financial crisis and the recent global pandemic, sales have not only rebounded but reached unprecedented heights.

Consumer behavior in times of hardship leans toward seeking solace in luxury items as a form of escapism. These symbols of success and quality offer a temporary escape from harsh realities. Notably, LVMH Moët Hennessy – Louis Vuitton, a global luxury conglomerate, recently exceeded €500 billion in market value, underscoring the resilience of the luxury market.

A significant contributor to this growth is the surge in demand from affluent Chinese consumers, expected to double to 200 million by 2025. Their insatiable appetite positions China as a vital market for luxury retailers globally.

Luxury Cars: Riding The Wave Of Exclusivity

In contrast to the stagnant mainstream automotive market, luxury cars, especially those exceeding half a million dollars, anticipate a remarkable 14% annual growth until 2031. This growth is propelled by intentional scarcity, where brands like Ferrari limit production to maintain exclusivity.

The COVID-19 pandemic and a global microchip shortage have elevated luxury car sales. The perception of value retention, advanced technology offerings, and diversification in price brands contribute to the appeal, with various segments experiencing growth rates.

Private Jets: Soaring Beyond Commercial Constraints

The private jet industry, synonymous with luxury transportation, witnesses a significant resurgence amid the pandemic. Charter flights have surged by 50-60%, driven by the flexibility, safety, and convenience private jets offer compared to commercial alternatives.

Pandemic-induced restrictions on commercial air travel have propelled the private jet charter industry forward. Affluent individuals and corporations prefer private jet travel to bypass limitations imposed on commercial airlines.

Luxury Real Estate: Resilient Amid Economic Challenges

Luxury real estate sales surged by 35% in 2022, fueled by factors like the shift to remote work and a desire for spacious living quarters. The flexibility of remote work led high-income earners to upgrade their residences, while the value of space became paramount during lockdowns.

The luxury real estate market proves resilient to high-interest rates due to cash-rich buyers, offering a buffer against economic downturns. However, industry experts anticipate a potential slowdown as the initial surge triggered by the pandemic settles.

Conclusion:

The adaptability and resilience of the luxury market in the face of global challenges underscore its enduring appeal. With emerging markets, especially in Asia, and a younger demographic contributing to sustained growth, the luxury sector looks poised for a promising future. As a wealth transfer unfolds over the next decade, maintaining exclusivity, adapting to changing consumer preferences, and embracing economic cyclical trends will be key to long-term, sustainable growth.